Inflation, economic crises, and climate issues are profoundly reshaping consumer habits.

Let’s take a closer look at the new consumption trends among e-shoppers, including:

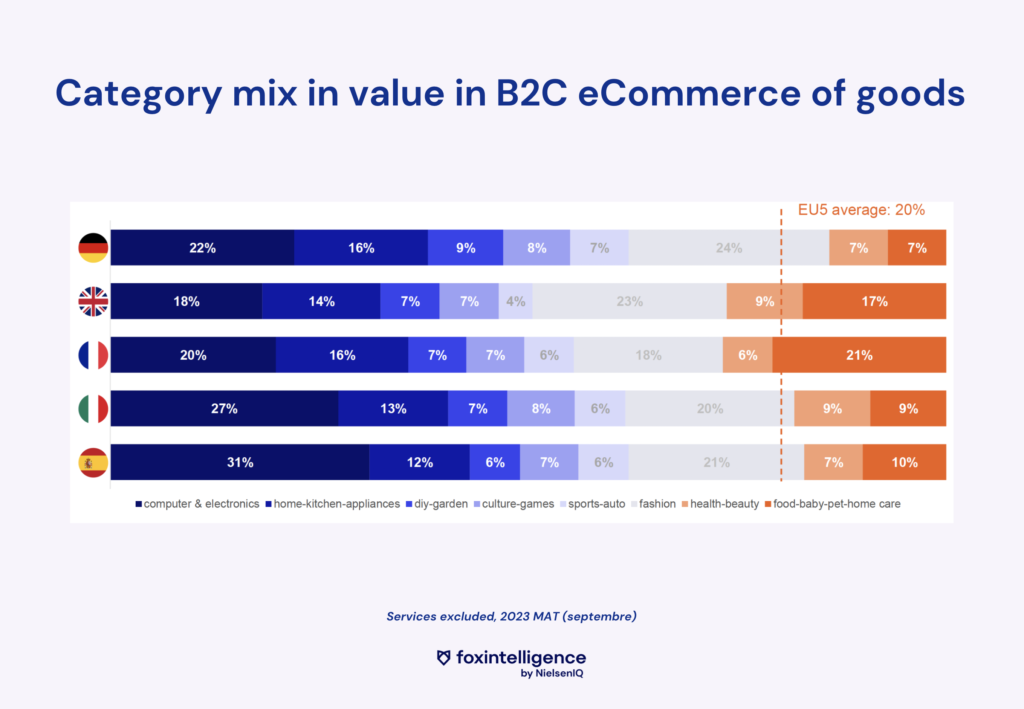

- The FMCG category gaining market share online in Europe

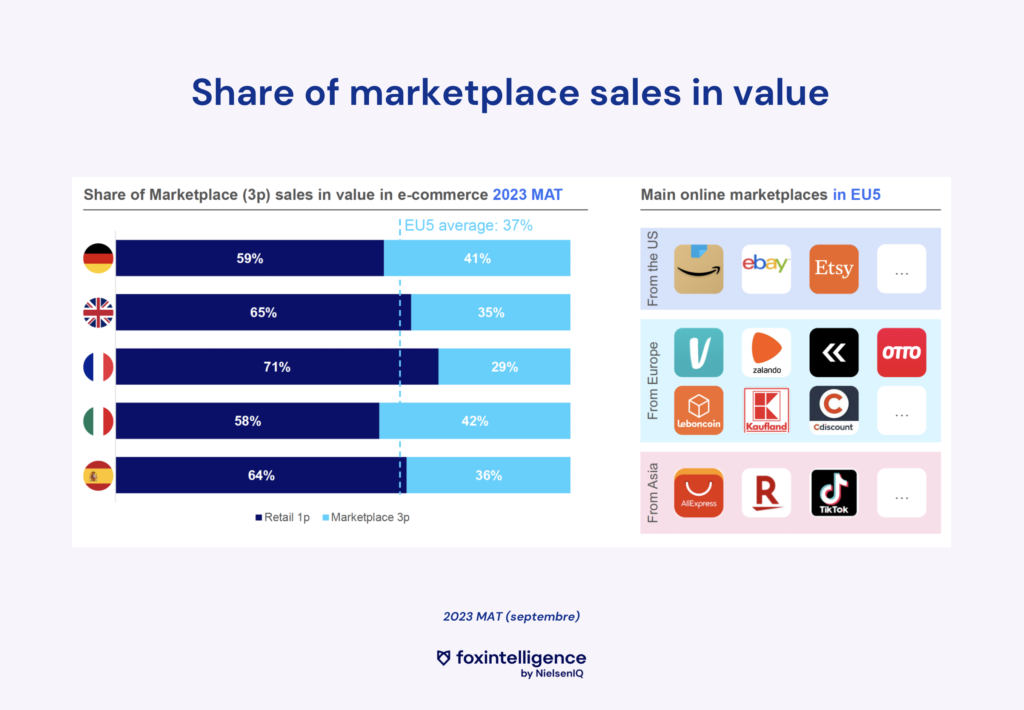

- Marketplaces playing a more substantial role in sales value

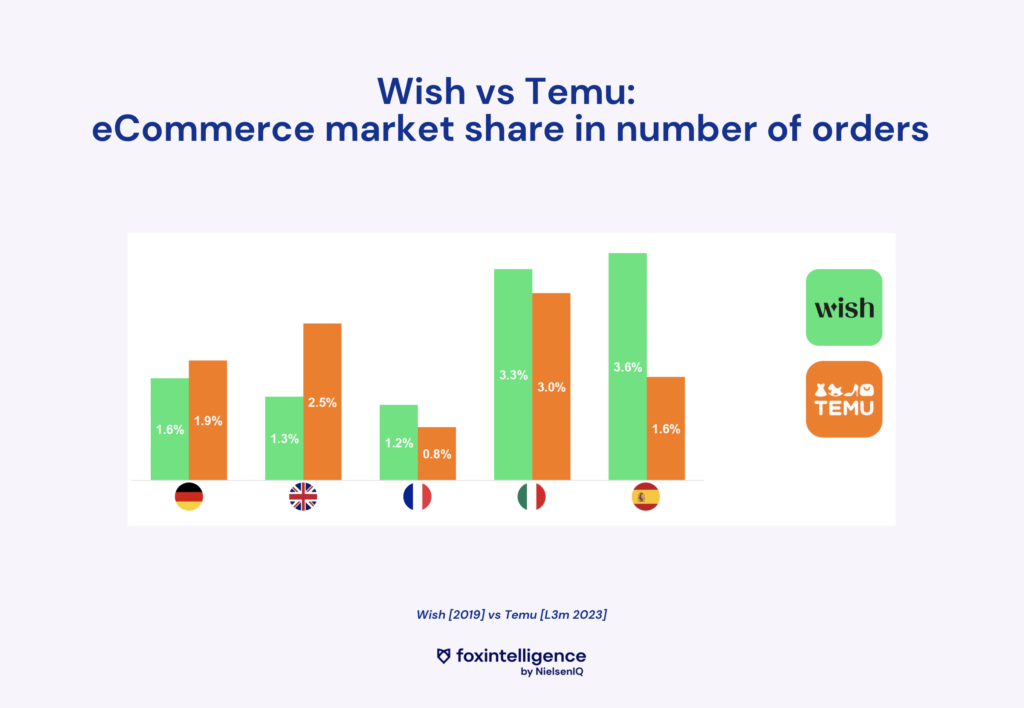

- The arrival of Temu in France

- TikTok Shop and Lidl making their mark in eCommerce

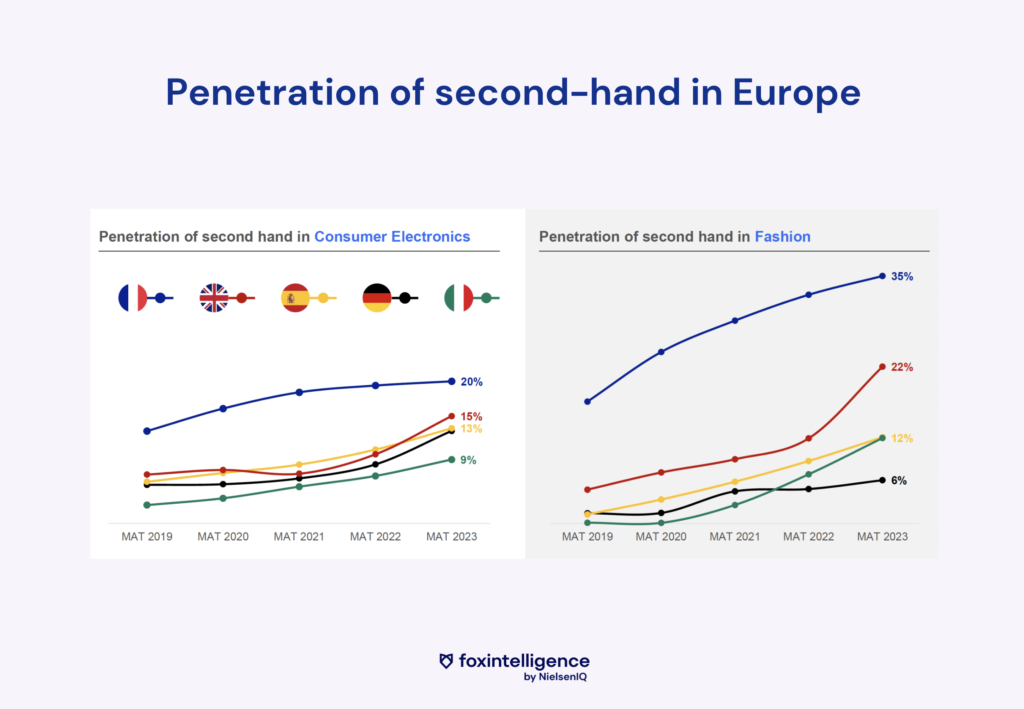

- Second-hand sales surging in Europe