Marketplace Model Increased by 3 Points in 2023

For retailers, marketplaces are an excellent way to expand their assortment in terms of categories – they have the opportunity to open new categories they were not present in and offer brands or products without managing the stocks. This represents a huge opportunity in terms of SEO since the more comprehensive a retailer’s offer, the more visible it will be on Google.

This opportunity comes with a challenge: dealing with internal competition between marketplace sales and the retailer’s retail sales. For retailers and brands, finding the right balance is essential.

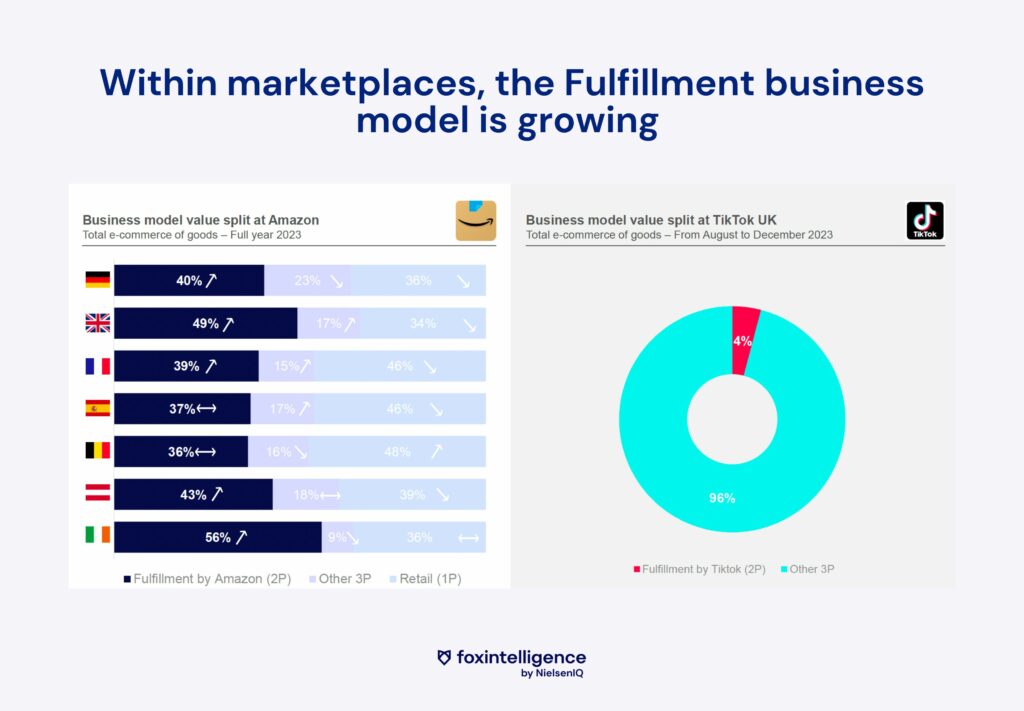

In the 9 Western European countries analyzed, marketplace sales accounted for 36% of online purchases in value in 2023.

🇫🇷 Taking France as an example, where the food category is strong, the marketplace model is less mature than in other countries. This may partly explain why the share of marketplace sales in France is lower than some European neighbors.

But the trend is present, and the 3-point increase is significant: marketplace sales are increasing more rapidly than traditional online sales.

Rise of Fulfillment

Fulfillment drives sales on marketplaces.

In eCommerce, fulfillment refers to all steps and measures taken by the seller following an order. Namely: preparation, packaging, delivery, order tracking, return management, customer service. Optimizing the fulfillment strategy allows maximizing the logistics of an eCommerce site to the fullest.

Sellers have two options: either they perform these operations themselves, or they can use a fulfillment specialist.

Amazon launched FBA, Fulfillment by Amazon. On the dedicated site, one can read “You sell, we ship”. Brands can thus rely on Amazon for the preparation, packaging, and shipment of their orders. They can store their products in Amazon distribution centers and take advantage of the platform’s distribution network.

It is observed that the FBA service dominates most countries and experiences faster growth than some other models observed.

Not to forget TikTok: in the UK, TikTok launched its marketplace and order processing service in August 2023. Looking at the figures until December, order processing already accounts for 4% of online purchases in value on TikTok Shop in the UK.

Order processing has become a key trend that is expected to continue to grow in 2024.