Inflation in the UK is reaching a new high: it’s the G7 country with the highest inflation, leading to a cost-of-living crisis of unparalleled proportions. Over the past 12 months, UK inflation rate has exceeded 10% – that’s more than double its french counterpart across the pond.

Today’s Topics:

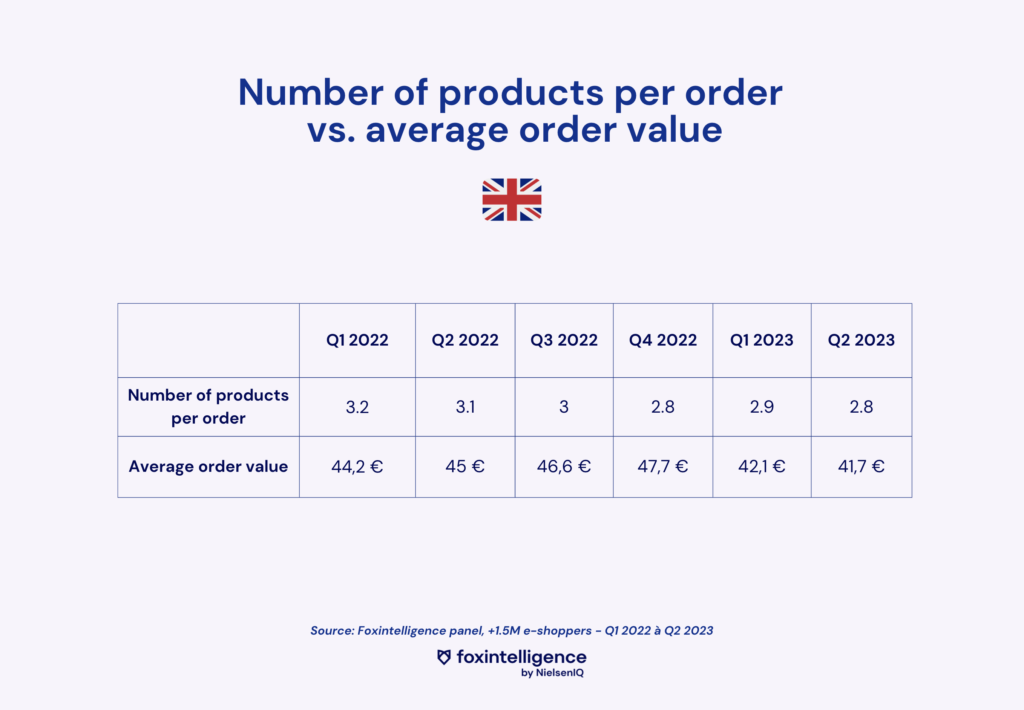

- The impact of inflation on online order content volume

- The evolution of the average basket

- Second-hand purchases, which are on the rise in times of inflation