TikTok redefines the expectations of beauty consumers

TikTok is the platform on which all kinds of tutorials have emerged: cleaning limescale from your bathroom with baking paper, making curtained fringes, or mastering contouring like Kim Kardashian – with TikTok, you can do it all.

But it’s the beauty sector that benefits the most from the platform: always on the lookout for new beauty tips, TikTok users like to experiment with new products, new techniques, discovering new beauty tricks. The GRWM (“Get Ready With Me”) content category has truly taken the platform by storm.

Before, social networks were the playground of brands. They used to promote their products to encourage users to buy. With Tiktok, the roles have changed. Users are taking back control. They create their own make-up, share it, make millions of views – and the brands are inspired to develop new products, new collections.

These are challenges that force the beauty industry to adapt.

What is the impact of TikTok Shop on UK e-commerce?

TikTok launched its online shop in the UK a few months ago – a country with 23 million monthly active users.

Over the last 12 months, out of the 8 best-selling products on the platform, 6 are beauty products. This figure is justified by the type of buyers on the platform: 71% of them are in fact female buyers.

The penetration rate by generation shows an over-representation of Generation Z. Around 60% of female buyers are from Generation Z, 29% from Generation Y and 10% from Generation X.

Generally speaking, 48% of the TikTok customers are from Gen Z, 34% from Gen Y and 15% from Gen X.

TikTok makes stereotypes hard to break

Looking at the categories most shopped on Tiktok, women prefer beauty products (29%) and clothes (17%) – while men opt first for electronic products (16%), with beauty only coming second (12%).

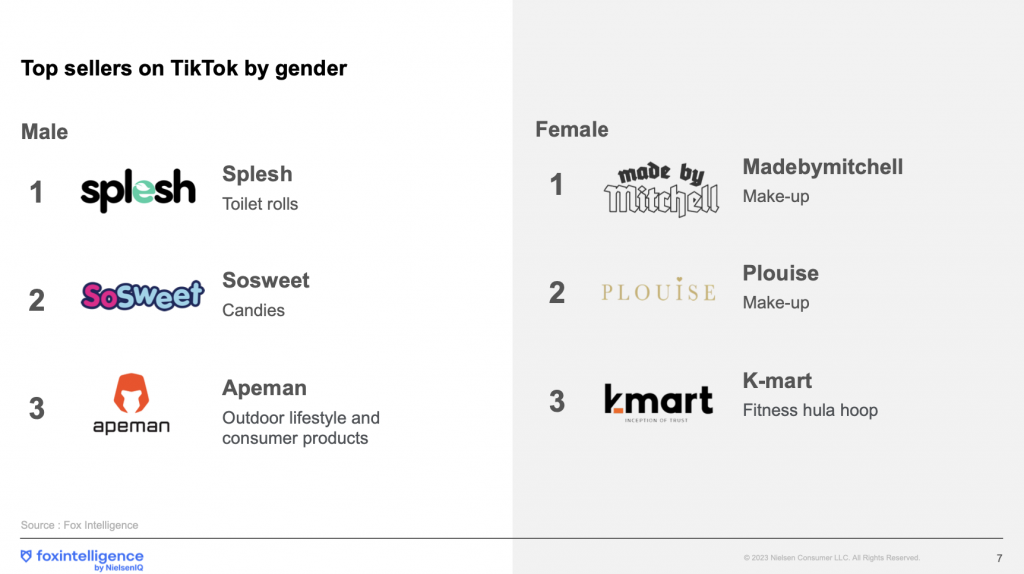

In terms of top selling products, men buy toilet paper and women buy make-up 🤷🏻♀️

TikTok: an opportunity for beauty brands

Buyers on TikTok spend more than the average on the category: €327 compared to €234 over the last 12 months. They also buy more often.

In total, they spend 17% of their beauty budget on Tiktok. A channel that comes in second place, just behind Amazon (23%).

In France, many brands are interested in this sales channel – needless to say, there’s a huge anticipation for its possible arrival in the country.