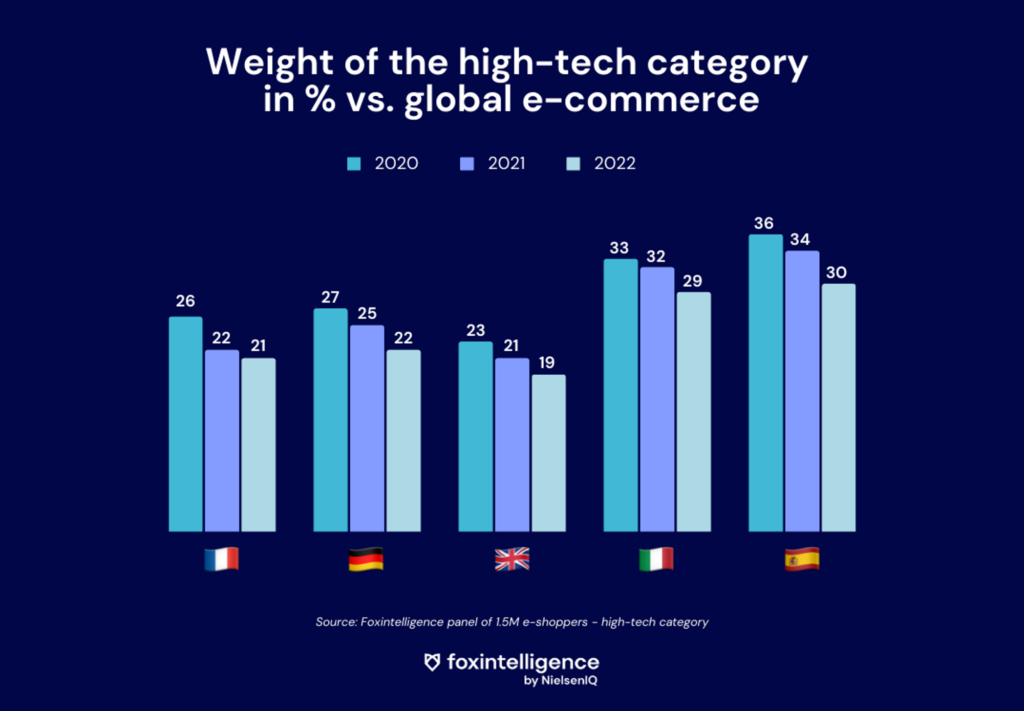

Consumers aren’t purchasing brand new tech as often as before.

2020 and 2021 were extremely profitable years for the sector: equipment for remote work or distance learning, for cooking, for entertainment, for wellness… Purchases of high-tech products were strongly boosted by the Covid period, the lockdowns and the increase in time spent at home. Naturally, consumers took this as a sign to improve their living comfort at home.

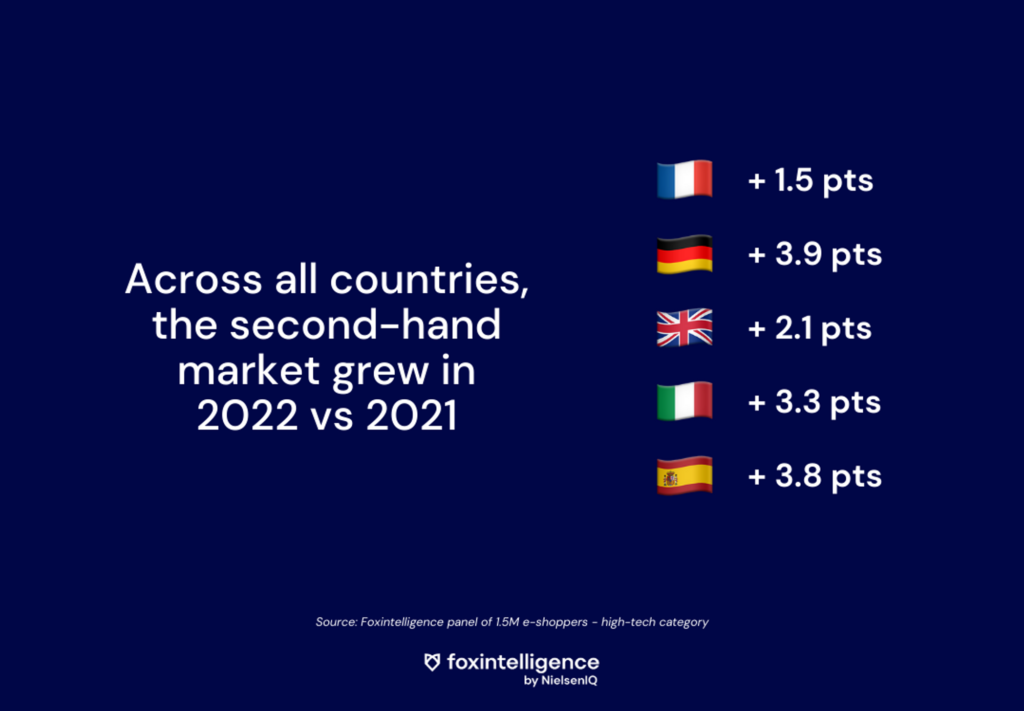

But after two years of growth, component shortages and inflation have forced consumers to curb their purchases and turn to second-hand products.

In this article, we observe the free-fall of the “new” market, the second-hand market in full swing, and how brands are adapting to this evolution.