Consumer confidence in Europe has hit its lowest point in 40 years. With cumulative and prolonged economic impacts and sustained inflation, consumers are reevaluating their spending habits.

For Black Friday 2023, did consumers exercise more caution in their spending, or were they actively seeking deals and promotions to save on Christmas purchases?

Discover:

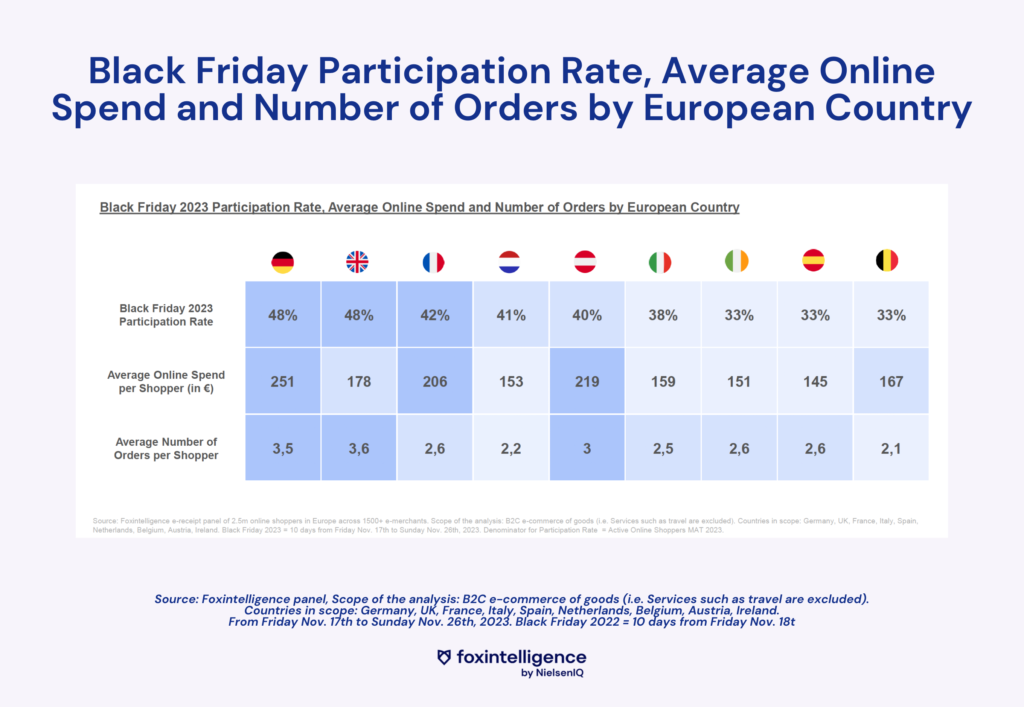

💶 Participation rates, average spending, and order numbers by country

🛍️ Categories driving the highest sales

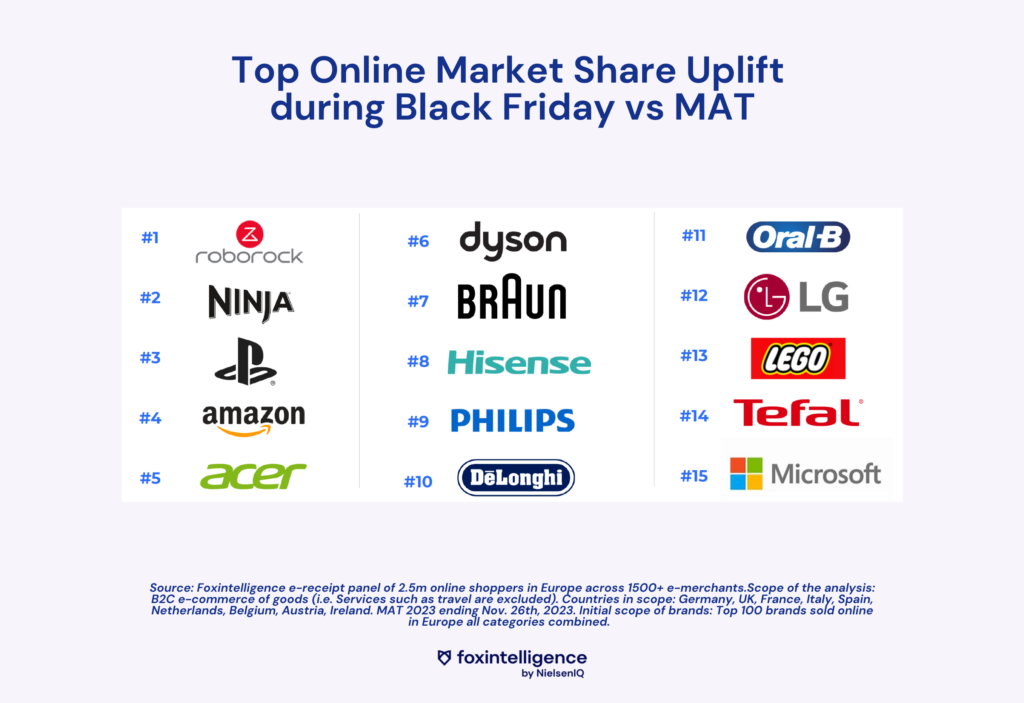

🏆 Brands that benefited the most from Black Friday this year